Fund type: |

Qualified investors’ fund |

Fund focus: |

Automobiles and motorcycles from 1950 – 2000 |

Investment strategy: |

Selection of unique, valuable and rare automobiles and motorcycles and subsequent sale |

First subscription period: |

April 1st, 2015 |

Security: |

Registered investment shares to name |

Fund duration: |

For an indefinite period |

Client’s minimum investment: |

125 000 EUR or equivalent in CZK |

Client’s investment horizon: |

5 - 7 years |

Fund manager: |

Versute investiční společnost, a.s. |

Depositary bank: |

ČSOB a. s. |

Auditor: |

Kreston Audit FlN, s.r.o. |

Portfolio appraiser: |

Znalecký institut s.r.o. |

Regulation and legal order: |

Czech National Bank, Czech republic |

ENGINE CLASSIC CARS – AUTOMOBILE FUND invests the monies entrusted to it in selected iconic and globally-known collector cars, motorcycles or automobilia in particular from the second half of the twentieth century. It therefore offers investors a unique opportunity to participate in a very interesting opportunity to place assets in the medium and long term.

Through this concept the fund provides its investors with the opportunity to diversify assets in an area that, from the long-term perspective, represents a unique opportunity not only to maintain, but also to continually increase the value of assets. In contrast to investments, for example in share indexes, such investments bring a markedly more stable return on money invested, and also a markedly lower correlation with selected share indicators.

In addition to this, it offers its investors the chance to participate in maintaining the history of iconic automobiles, which in many cases are unique for the relevant makes. The fund will not be focused only on automobiles in higher price bands, but its portfolio will include automobiles that, thanks to their history or nature, were greatly sought-after at their time and whose acquisition is not markedly financially demanding, but where the expectation of growth in their value is very high.

The Fund’s basic idea is to offer investors the chance of transparently placing free monies through targeted purchases of pre-selected automobiles, motorcycles or automobilia in the context of current conditions on the market and their timed sale with a return for a shareholder.

In addition to this, the Fund offers a little something extra. You will become part of a unique society, a club for investors and fans of this traditional industry, you will have the chance to participate in joint meetings and events that the Fund arranges for its investors. It is not only an investment, but also the sharing of a common passion and enthusiasm for owning such beautiful and historically interesting motoring icons.

|

ENGINE PRAGUE s. r. o. is part of the ENGINE group that arranges comprehensive motoring services (new and classic cars), wide-ranging and detailed renovation of classic cars and the sale and purchase of cars of all categories; for five years it has been organising the classic automobile race PRAGUE CARLSBAD CLASSIC with a large share of foreign participants.

ENGINE PRAGUE is the owner of a value collection of classic cars and motorcycles. It operates a sports car parking club in the capital‘s centre, where, in a club atmosphere, it also organises auctions of cars, motorcycles and automobilia, concerts and other social events. ENGINE PRAGUE’s philosophy is to build up a centre of automobile culture in combination with a museum/gallery that will, together under one roof, offer everything that a person could want in connection with history and classic cars.

BH Securities a. s. is a licensed securities trader and a member of the Prague Stock Exchange (Burza cenných papírů Praha a.s.). The company was established in 1993 and is part of the Czechoslovak holding company PROXY – FINANCE, a.s., which is also its 100% owner. BH Securities a.s. is one of the most important domestic financial non-bank entities. Thanks to its long-term activities it has obtained a wealth of experience and built up a strong position on the Czech capital market, enjoying customers‘ trust.

It provides comprehensive services on the capital market for institutional investors and individuals. The company’s main activity is trading in securities on its own account and on the account of others, at home and abroad, the management of customer portfolios (asset management), margin trading and trading in financial derivatives, primarily bond issues and investment certificates. At the current time it takes care of client assets totalling almost CZK 4bn.

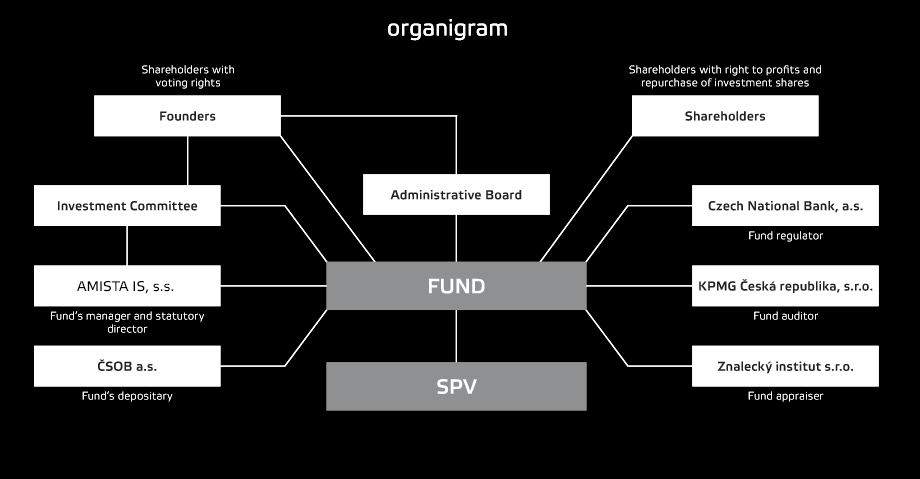

AMISTA investiční společnost, a. s. specialises in establishing and managing qualified investors’ funds. In the last three years AMISTA has become the most dynamically growing investment company in the Czech Republic and is currently the second largest investment company on the FKI market.

AMISTA manages 28 funds with a net asset value of CZK 10.4bn. AMISTA obtained its position on the market primarily through its personnal client-centric approach, experience, flexibility and the quality of services provided. The funds manages its invest in commercial properties, residential projects, agricultural land, receivables, works of art and ownership interests in start-up projects or in existing companies that AMISTA helps with further development, finances the processing of precious metals and renewable energy sources.